XXVIII Meeting of the Central Bank Researchers Network - 2023 CEMLA Conference

Call for Papers

November 9 - 10, 2023 – Mexico City (hybrid)

The Center for Latin American Monetary Studies (CEMLA) is organizing its XXVIII Meeting of the Central Bank Researchers Network, to be held on November 9 - 10, 2023. CEMLA invites contributions from papers in which at least one co-author is affiliated to a CEMLA Member Institution (Associate or Collaborating). Notwithstanding the above, authors affiliated to other external institutions are also welcome to submit their papers, for whom a limited number of slots in the program will be considered.

Papers accepted for presentation will be discussed by another speaker within the same session. Accepted papers, as well as presentations and discussions, will be posted on the Conference website to facilitate the discussion among participants.

Keynote Speakers

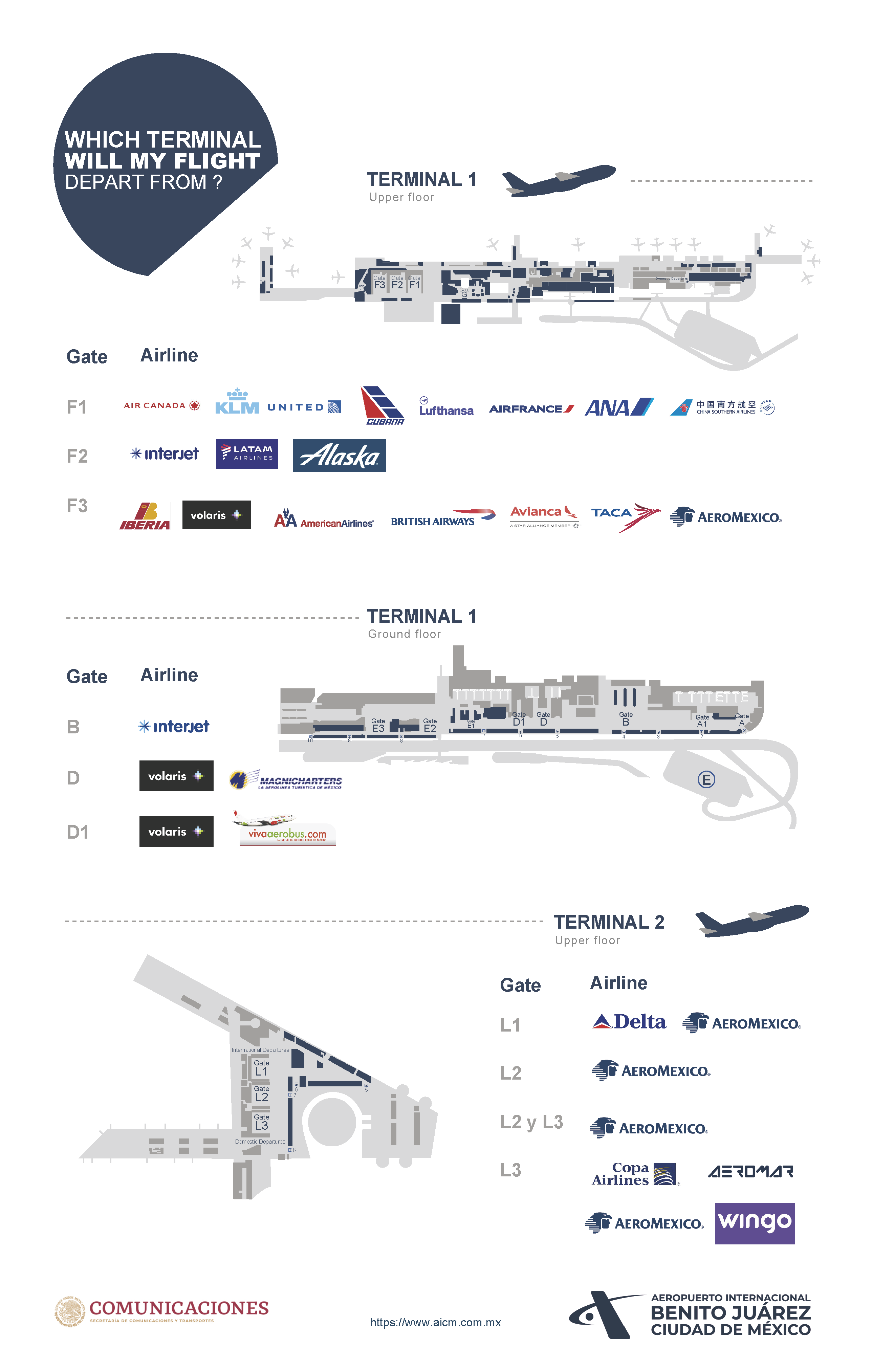

Venue

The conference will be held at CEMLA’s facilities in Mexico City in a hybrid format (in-person and digital). There is no registration fee. However, participants are expected to pay their expenses for travel and accommodation.

Conference Special Issue

A special issue of the Latin American Journal of Central Banking (LAJCB) will include selected papers presented at the conference. Authors who wish their paper to be considered for the Special Issue, should clearly indicate this in their conference submission.

Special Issue Award

All accepted papers in the Special Issue will receive a compensation of 1,000 USD each, which CEMLA will fund. If the paper participates in any other CEMLA award, it will only be eligible for the monetary prize once.

Important Dates

August 4, 2023. Submission deadline. Please submit your paper to network@cemla.org

August 24, 2023. Notification of paper acceptance

September 4, 2023. Deadline for conference registration (there is no registration fee)

November 9 - 10, 2023. Conference dates

Scientific Committee

David Argente, Pennsylvania State University

Isaac Baley, Universitat Pompeu Fabra

Corina Boar, New York University

Javier García-Cicco, Universidad del CEMA

Gerardo Hernández-del-Valle, CEMLA

Peter Karlström, CEMLA

Pablo Kurlat, University of Southern California

Gustavo Leyva, CEMLA

Carola Müller, CEMLA

Matías Ossandon Busch, CEMLA

Nelson Ramírez-Rondán, CEMLA

Veronica Rappoport, London School of Economics

Sebastian Sotelo, University of Michigan, Ann Arbor

Benjamín Tello Bravo, CEMLA

Organizing Committee

Gerardo Hernández-del-Valle, CEMLA

Gustavo Leyva, CEMLA

Matías Ossandon Busch, CEMLA

Nelson Ramírez-Rondán, CEMLA

XXVIII Meeting of the Central Bank Researchers Network - 2023 CEMLA Conference

Available in October

XXVIII Meeting of the Central Bank Researchers Network - 2023 CEMLA Conference

Michele Boldrin

Michele Boldrin is the Joseph Gibson Hoyt Distinguished University Professor and Chair at the Department of Economics, Washington University in Saint Louis; he is also currently a Fellow of the Econometric Society, an Associate Editor of Econometrica, an Editor of the Review of Economic Dynamics, and the Book Review Editor of Macroeconomic Dynamics, a Research Fellow of CEPR (London) and FEDEA (Madrid), and an economic advisor to the Federal Reserve Bank of Saint Louis and to the Bank of Japan. He received his Ph.D. and Master of Science in Economics at the University of Rochester, NY. His research focuses on the theory and application of Dynamic General Equilibrium models. His main publications appear in American Economic Review, Econometrica, Journal of Political Economy, Review of Economic Studies, Journal of Economic Theory, among others.

Saki Bigio

Saki Bigio is an Associate Professor at the Department of Economics of the University of California, Los Angeles (UCLA); previously, he was an Assistant Professor at Columbia Business School. Bigio has held Visiting Scholar positions at Princeton University and the Federal Reserve Bank of San Francisco. He received his Ph.D. in Economics at the New York University, NY. His work is focused on the theoretical and quantitative nexus between financial-market liquidity, credit, payment systems and the macroeconomy. His main publications appear in American Economic Review, Quarterly Journal of Economics, Econometrica, European Economic Review, American Economic Journal: Macroeconomics; Journal of Political Economy Macroeconomics, among others.