Disponible en

Español

![]()

V Meeting of Heads of Financial Market Infrastructures

November 4 - 5, 2024

CEMLA Mexico City, Mexico

The CEMLA and the Banco de España organized the V Meeting of Heads of Financial Market Infrastructures, held in person on November 4 and 5, 2024. The event was attended by 33 representatives from 13 institutions belonging to CEMLA’s Associate and Collaborating members, representing 12 countries.

The first session addressed the topic of instant payments. In Europe, the importance of a solid regulatory framework (SEPA scheme) and the support of authorities (such as regulations to promote its use) for the expansion of instant payment systems was highlighted. In Costa Rica, the growth of the SINPE mobile payment system was presented, emphasizing its advantages and challenges. The second session focused on wholesale payment systems, analyzing the cases of Bolivia and El Salvador. It was emphasized that systems already consolidated before the COVID-19 pandemic increased their transaction volumes, strengthening their relevance. The last session of the day was on operational resilience and cybersecurity, highlighting the roles of entities in monitoring and supervision, as well as the importance of collaborative exercises to identify vulnerabilities and improve responses to cyber incidents. Finally, the fourth session discussed cross-border payments, addressing current challenges such as costs, settlement speed, access, and transparency. Efforts by the G20 to improve these aspects were highlighted, and the strengths and areas for improvement in the Central American payment interconnection system (SIPA) were analyzed.

The second day included three sessions. The first focused on the interoperability of payment systems, highlighting the progress made by the Banco de la Republica de Colombia in implementing IBAN under ISO 13616 and its new public digital infrastructure. Progress by the Banco de Mexico and challenges in cross-border payment interoperability were also presented, with 76% of transactions originating from the U.S. The second session addressed shortening the settlement cycle to T+1. In the European Union, benefits such as reduced counterparty risk and process modernization were highlighted, as well as challenges like increased settlement failures and liquidity requirements. In Mexico, the success in reducing the settlement cycle was emphasized, achieved through coordination between authorities and regulatory adjustments. The last session was dedicated to Central Bank Digital Currencies (CBDCs), analyzing the challenges of the digital euro project and its objectives, as well as the pilot digital currency in Peru, which prioritizes gradual implementation and strategies for financial inclusion and education.

Valentina Bruno

Valentina Bruno is the Arlene R. and Robert P. Kogod Eminent Professor of Finance at American University’s Kogod School of Business. She holds a Master’s in Finance and Economics and a Ph.D. in Finance from the London School of Economics. Before joining American University, she worked at the World Bank in the Financial Sector Strategy and Policy Group and the International Finance Team. Professor Bruno is a Research Fellow at the Center for Economic Policy Research (CEPR), a Faculty Research Member at the European Corporate Governance Institute (ECGI), and an Associate Editor at the Journal of Banking and Finance. She has been a visiting scholar at the Federal Reserve Board and a Council on Foreign Relations (CFR) Fellow in International Economics. Professor Bruno’s research focuses on the intersection of macroeconomics and finance, opening new lines of inquiry into how global financial markets interact with the real economy. Her recent work emphasizes the role of the US dollar in the transmission of global financial conditions. Widely cited in both media and policy circles, her scholarship combines economic theory with empirical evidence to inform policy-making and regulatory efforts. Her work has appeared in Financial Times, The Wall Street Journal, Bloomberg, and on the cover of The Economist. Additionally, her research has been published in leading academic journals such as the Review of Economic Studies and the Review of Financial Studies.

José Berrospide

Jose Berrospide is the Assistant Director in the Division of Financial Stability at the Federal Reserve Board in Washington, D.C. In this role, he leads and oversees the team responsible for identifying and measuring systemic risks in banks and other financial institutions. Mr. Berrospide conducts policy analysis and research in the areas of financial stability, supervisory stress tests, and the regulation of systemically important financial institutions. His primary research interests include banking, financial institutions, and empirical corporate finance. His current research focuses on the effects of bank capital and capital regulation on lending, the usability of bank capital buffers, credit supply shocks on SMEs during the pandemic, the transmission of shocks through multi-market banks, the cross-border effects of regulations, banks' liquidity hoarding, and the real effects of corporate credit lines. His research has been published in top outlets, including the Journal of Financial Intermediation, among others. Mr. Berrospide holds a Ph.D. in Economics from the University of Michigan.

Institución

- V. Hugo Juan-Ramón

Allen N. Berger

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque in dapibus felis. Nulla mattis, odio eu fermentum ullamcorper, felis ex imperdiet nunc, sit amet aliquet sapien magna a lacus. Suspendisse viverra rutrum ante, ut egestas justo gravida ut. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Suspendisse efficitur ligula non ex lacinia, ac egestas risus vehicula. Sed cursus turpis vel turpis pellentesque, non maximus velit aliquet. Aliquam eget magna pretium, pellentesque neque at, ultrices massa. Nunc egestas a metus vel tincidunt. Sed faucibus sed turpis sed rutrum. Aliquam eget tincidunt orci, vel porttitor tellus. Etiam cursus commodo porta. Phasellus sit amet purus orci. Duis condimentum tortor eros, vitae suscipit arcu porttitor nec.

Información del Lugar

CEMLA está ubicado en Durango 54, Col. Roma, Alcaldía Cuauhtémoc, C.P. 06700 Ciudad de México, México, cerca del centro de la Ciudad de México. La ciudad se encuentra en el centro del país, a una altitud promedio de 2,300 metros sobre el nivel del mar, y limita con el Estado de México y el estado de Morelos. La capital está conectada por tierra con múltiples destinos.

Zona Horaria

México tiene una diferencia horaria con el Tiempo Medio de Greenwich de -6 horas.

Clima

En Ciudad de México, la temporada de lluvias es cálida y nublada, mientras que la temporada seca es cómoda y parcialmente nublada. A lo largo del año, la temperatura suele oscilar entre 6°C y 26°C, y rara vez baja de 3°C o supera los 30°C.

La temporada cálida dura 2.5 meses, desde el 22 de marzo hasta el 8 de junio, con una temperatura diaria promedio superior a 20°C. El mes más cálido del año en Ciudad de México es mayo, con una temperatura máxima promedio de 27°C y mínima de 13°C.

La temporada fresca dura 2.5 meses, desde el 19 de noviembre hasta el 3 de febrero, con una temperatura máxima diaria promedio inferior a 22°C. El mes más frío del año en Ciudad de México es enero, con una temperatura mínima promedio de 6°C y máxima de 22°C.

Información de Visas

Todos los participantes son responsables de los trámites de pasaporte y visa, y de cumplir con las regulaciones de salud si es necesario.

Los ciudadanos de ciertos países requieren visa para ingresar a México. En el siguiente enlace encontrarás una lista de las nacionalidades que requieren visa: Países que requieren visa.

Las excepciones se aplican si tienes una visa o eres residente permanente de Estados Unidos, Canadá o Europa. Si eres ciudadano de un país que requiere visa, por favor contacta al consulado mexicano más cercano: Consulados mexicanos.

Moneda y Tipo de Cambio

La moneda oficial es el peso mexicano (MXN).

Para consultar el tipo de cambio actualizado, haz clic aquí.

Puedes realizar cambios de moneda en casas de cambio y en algunas oficinas bancarias. Se recomienda cambiar dinero en el aeropuerto, ya que las casas de cambio y los bancos cercanos a CEMLA y a los hoteles recomendados cierran los fines de semana y terminan su jornada temprano durante la semana (alrededor de las 16:00 hrs). Por lo general, los cajeros automáticos están disponibles las 24 horas. Puedes retirar efectivo utilizando tarjetas de débito y crédito internacionales con marcas mundiales como Visa, Mastercard, Visa Electron y Dinners. Para más información, visita Banco de México.

IVA y Otros

- IVA: 16%.

- Servicio hotelero: cargo adicional del 3.5% sobre el alojamiento (ISH o impuesto de alojamiento).

- Propinas en restaurantes: de 10% a 15%, dependiendo del servicio recibido.

Servicio de Electricidad

Energía: 127 voltios AC a 60 ciclos (127V AC, 60 Hz). Enchufes de dos clavijas planas y algunos con conexión a tierra.

Transporte

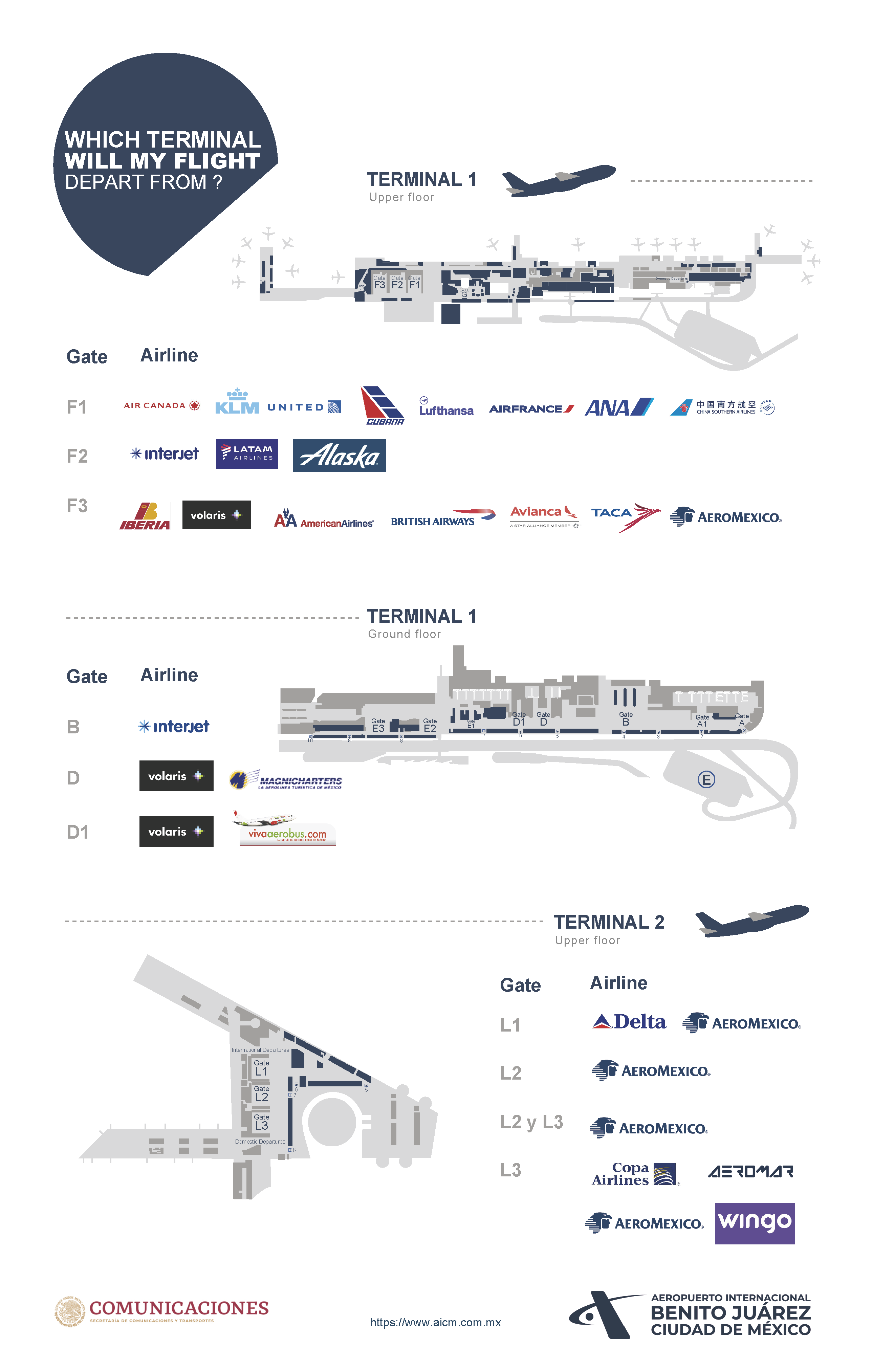

El Aeropuerto Internacional Benito Juárez en Ciudad de México se encuentra a 13 kilómetros del centro. Tiene dos terminales identificadas como Terminal 1 y Terminal 2, conectadas por aerotrén y transporte gratuito en autobús. Para más información, visita el sitio web del aeropuerto aquí.

Al llegar a Ciudad de México, el transporte desde el aeropuerto hasta los hoteles puede hacerse mediante aplicaciones de transporte (como Uber, Cabify, Didi y Lyft, entre otras) o en taxi. Para tomar un taxi, es importante seleccionar una empresa de taxis dentro del aeropuerto (hay varias opciones disponibles una vez que salgas de aduanas e inmigración), pagar al cajero dentro del aeropuerto y solicitar el taxi en la salida correspondiente. El Aeropuerto Internacional de la Ciudad de México (AICM) ofrece espacios o áreas de abordaje para el uso de taxis autorizados acreditados por la Secretaría de Comunicaciones y Transportes (SCT) y regulados por el Aeropuerto. Para más información sobre taxis autorizados, haz clic aquí.

Para el transporte dentro de Ciudad de México, recomendamos usar aplicaciones de transporte o servicios de taxi desde los stands “SITIO”. Se recomienda evitar tomar taxis de la calle. Los stands SITIO se encuentran en varias ubicaciones y los números de teléfono para solicitar taxis se pueden obtener en los hoteles. CEMLA no proporcionará servicios de transporte.

Alojamiento

La siguiente tabla muestra los hoteles recomendados por CEMLA, las tarifas disponibles para los participantes del evento y la información de contacto de los hoteles. La reserva de hoteles es responsabilidad de los participantes. Ten en cuenta que los hoteles suelen solicitar una tarjeta de crédito para garantizar la reserva. Las tarifas incluyen 16% de IVA y 3.5% de ISH (impuesto local). Para recibir la tarifa corporativa en los hoteles recomendados, debes especificar el nombre de CEMLA. Cualquier cambio en las tarifas es responsabilidad de cada hotel. Aunque algunas reservas se pueden hacer en línea, recomendamos contactar directamente con el hotel para asegurarte de que se aplique la tarifa grupal.

Hoteles recomendados

Hotel

Tarifa

Información para reservaciones

Stanza

Av. Álvaro Obregón 13, Roma Nte., Cuauhtémoc, 06700 Ciudad de México, CDMX

(3 minutos en auto, 6 minutos caminando, a 500 m del CEMLA)

Tarifa ordinaria por noche:

$ 125 USD

Tarifa corporativa CEMLA:

$ 83 USD, impuestos incluidos

Teléfono: + 52 55 5080 0900

Royal Reforma

C. Amberes 78, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(10 minutos en auto, 13 minutos caminando, a 1 km del CEMLA)

Tarifa ordinaria por noche:

$ 165 USD

Tarifa corporativa CEMLA:

$ 81 USD

Servicios:

Impuestos, Wi-Fi, desayuno buffet, gimnasio, piscina, sauna (bajo petición)

Teléfono: +52 55 9149 3000

Four Points by Sheraton

Av. Álvaro Obregón 38, C. U. Benito Juárez, Cuauhtémoc, 06700 Ciudad de México, CDMX

(5 minutos en auto, 6 minutos caminando, a 500 m del CEMLA)

Tarifa ordinaria por noche:

$ 210 USD

Tarifa corporativa CEMLA:

$

114

USD

sólo

alojamiento

$

130

USD

alojamiento

y

desayuno

buffet

Servicios:

Impuestos, Wi-Fi, fitness center

Teléfono: +52 55 1085 9500

City Express Plus Reforma El Angel

Av. Paseo de la Reforma 334, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(10 minutos en auto, 20 minutos caminando, a 1.6 km del CEMLA)

Tarifa ordinaria por noche:

Please consult directly with the hotel.

Servicios:

wi-fi, desayuno

Teléfono: +52 55 5228 7800

Sheraton Mexico City María Isabel

Av. Paseo de la Reforma 325, Cuauhtémoc, 06500 Ciudad de México, CDMX

(13 minutos en auto, 21 minutos caminando, 1.6 km del CEMLA)

Tarifa ordinaria por noche:

Según la demanda

Tarifa corporativa CEMLA:

$ 198 USD

Servicios:

Impuestos, Wi-Fi, desayuno buffet, gimnasio

Teléfono: +52 55 52425672

Marriot Reforma

Av. Paseo de la Reforma 276, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(15 minutos en auto, 17 minutos caminando, a 1.3 km del CEMLA)

Tarifa ordinaria por noche:

$ 419 USD

Tarifa corporativa CEMLA:

$ 207 USD

Servicios:

Impuestos, Wi-Fi en centro de negocios, desayuno buffet, gimnasio

Teléfono: +52 55 1102 7030

Brick Hotel

Orizaba 95, Roma Nte., Cuauhtémoc, 06700 Ciudad de México, CDMX

(6 minutos en auto, 7 minutos caminando, a 500 m del CEMLA)

Tarifa ordinaria por noche:

Please consult directly with the hotel.

Teléfono: +52 55 9155 7610

Mapa

Visita a México

Ciudad de México es un destino turístico único que ofrece una amplia gama de atracciones que combinan la vida histórica y moderna en una atmósfera vibrante y amigable. Dedica un día a visitar las ruinas prehispánicas de Teotihuacán, o recorre el Centro Histórico y maravíllate con su rica arquitectura, desde la Catedral y la Plaza del Zócalo hasta el Palacio de Bellas Artes. Visita museos de clase mundial o pasa el día en algunos de los vecindarios modernos y disfruta de una experiencia gastronómica en algunos de los restaurantes mejor calificados del mundo. Para más información, visita: Guía oficial para turistas de la CDMX.

Gastronomía

Ciudad de México ofrece una gran variedad de restaurantes, la mayoría ubicados en las áreas turísticas de Polanco, Roma y Condesa, cerca del lugar del evento.

Visitas Turísticas/Excursiones

Si planeas quedarte un día o dos adicionales en Ciudad de México, te recomendamos dedicar un día a visitar el Centro Histórico, Coyoacán, la Avenida Reforma, la Colonia Roma, Xochimilco y Chapultepec.

Se puede organizar una excursión de un día a Teotihuacán para ver las pirámides con el concierge del hotel.

Ciudad de México ofrece algunos museos de clase mundial, incluidos el Museo de Antropología, el Museo Soumaya y el Museo Interactivo de Economía.

COVID-19 Protocol

CEMLA Health Protocol based on the suggestions of the Pan-American Health Organization

- Body-temperature checks and provision of hand-sanitizing gel and face-masks at the entrance of our facilities.

- Limited capacity in rooms to comply with a minimum distancing of 1.5m between individuals.

- Rodrigo Gómez Auditorium has been equipped with an air-ventilation system with UV-C light air purifiers and air-exhaust systems.

- Javier Marquez Room, Multimedia Room, restrooms and boardrooms, among other rooms, have been equipped with UV-C light conditioning.

- CO2 and humidity monitors in the main spaces of the building.

- Open-door room policy.

- Cleaning and maintenance plans after regular occupation hours.

- Regular updates based on the tracking of recommendations of the health authorities in Mexico and International Organizations.

2024 Latin American Journal of Central Banking

(LAJCB)

Conference

Call for Papers

May 23 - 24, 2024 – Mexico City (hybrid)

The Center for Latin American Monetary Studies (CEMLA) is pleased to organize the second edition of the Latin American Journal of Central Banking (LAJCB) Conference, to be held on May 23 - 24, 2024 at CEMLA’s headquarters in Mexico City. CEMLA invites paper contributions within the broad range of topics of interest to central banks, including (but not limited to) monetary theory and policy, financial intermediation (both theory and empirics), climate-related aspects of financial stability and monetary policy, digitalization and financial markets, and payments and market infrastructures. The Conference is open to papers that may or may not seek to be published in the LAJCB.

Papers accepted for presentation will be discussed by another speaker within the same session. Accepted papers, presentations, and discussions will be posted on the Conference website to facilitate the discussion among participants.

Keynote Speakers

- Allen N. Berger, University of South Carolina

- David Argente, Yale University

Venue

The Conference will be held at CEMLA’s facilities in Mexico City in a hybrid format (in-person and digitally). There is no registration fee. There is a limited budget to cover economy flights for in-person presenters.

LAJCB Publication

Papers accepted for the Conference are invited (there is no obligation) to be submitted to the Latin American Journal of Central Banking. Authors who wish their paper to be considered for the LAJCB should clearly indicate this in their Conference submission.

Monetary Award

All accepted papers in the LAJCB will receive a compensation of 1,000 USD each, which CEMLA will fund. The monetary prize will be divided in equal parts among each paper's authors. If the paper participates in any other CEMLA award, it will only be eligible for the monetary prize once.

Important Dates

March 22, 2024. Submission deadline. Please submit your paper to conference@cemla.org

April 5, 2024. Notification of paper acceptance

April 15, 2024. Deadline for Conference registration (there is no registration fee)

May 23 - 24, 2024. Conference dates

Scientific Committee

- José Berrospide, Federal Reserve System

- Nicola Branzoli, Banca d'Italia

- Jens Christensen, Federal Reserve Bank of San Francisco

- Mariela Dal Borgo, Banco de México

- Carlos Madeira, Banco Central de Chile

- Gerardo Hernández-del-Valle, CEMLA

- Gustavo Leyva, CEMLA

- Serafín Martínez-Jaramillo, Banco de México

- Esteban Méndez, Banco Central de Costa Rica

- Carola Müller, Bank for International Settlements

- Matías Ossandon Busch, CEMLA

- Jorge Ponce, Banco Central del Uruguay

- Nelson Ramírez-Rondán, CEMLA

- Bárbara Sadaba, Bank of Canada

- Miguel Sarmiento, Banco de la República

- Thiago Silva, Banco Central do Brasil

Organizing Committee

- Gerardo Hernández-del-Valle, CEMLA

- Gustavo Leyva, CEMLA

- Matías Ossandon Busch, CEMLA

- Nelson Ramírez-Rondán, CEMLA