Disponible en Español ![]()

CEMLA Course: Financial Mathematics (practical)

November 19 - 21, 2025

CEMLA Mexico City, Mexico

Face-to-face format

Organizing Institutions

Center for Latin American Monetary Studies, A. C. (CEMLA)

Content

This course will review the topics covered in the CEMLA Course: Introductory Financial Mathematics, but with an emphasis on developing practical case studies. Additionally, other topics will be explored, such as the use of machine learning techniques in derivative valuation and hedging strategies.

Objective

The objective of the course is to deepen the practical application of financial mathematics by addressing real-world cases and exploring advanced tools, such as machine learning, for derivative valuation and hedging strategy design. Furthermore, it aims to complement the knowledge acquired in the CEMLA Course: Introductory Financial Mathematics, with a problem-solving and decision-making approach in financial markets.

Aimed at

This course is designed for analysts, junior researchers, and mid-level officials working in economic research, financial stability, risk management, or related areas within CEMLA member institutions who have participated in the CEMLA Course: Introductory Financial Mathematics.

Coordinator

Gerardo Hernández del Valle

Directorate of Financial Markets Infrastructures

Venue Information

CEMLA is located in Durango 54, Col. Roma, Cuauhtémoc, C.P. 06700 Ciudad de México, México; near downtown Mexico City.

Mexico City is located near the center of the country, at an average altitude of 2,300 meters above sea level, bordering the State of Mexico and the state of Morelos. The capital is connected by land to multiple destinations.

Time Zone

Mexico has a time difference with Greenwich Mean Time of -6 hours throughout its territory.

Weather

In Mexico City, the wet season is warm and overcast and the dry season is comfortable and partly cloudy. Throughout the year, the temperature usually ranges from 6°C to 26°C and is rarely below 3°C or above 30°C.

The warm season lasts for 2.5 months, from March 22 to June 8, with an average daily temperature above 20°C. The hottest month of the year in Mexico City is May, with an average high of 27°C and low of 13°C.

The cool season lasts for 2.5 months, from November 19 to February 3, with an average daily high temperature below 22°C. The coldest month of the year in Mexico City is January, with an average low of 6°C and high of 22°C.

Visa Information

All participants are responsible for all Passport and visa formalities, and if needed, to comply with health regulations.

Citizens of certain countries require a visa to enter Mexico. In the following link you will find a list of citizenships which require visas: Countries that require visas.

Exceptions apply if you have a visa or if you are a permanent resident of the United States, Canada or Europe. If you are a citizen of a country requiring a visa, please contact the closest Mexican consulate at: Mexican consulates.

Currency and Exchange Rate

Official currency: Mexican peso (MXN).

For the updated exchange rate click here.

You will be able to make currency exchanges at exchange houses and in some bank offices. It is recommended to exchange money at the airport since exchange houses and banks near CEMLA and the suggested hotels are closed on weekends, and close early during the week (around 16:00 hrs). Usually, ATMs are available 24 hours. You may draw cash using international debit and credit cards with worldwide brands, like Visa, Mastercard, Visa Electron and Dinners. For more information, please visit (Banco de México) here.

VAT and others

- · VAT: 16%.

- · Hotel service: additional charge of 3.5% on top of lodging (ISH or lodging tax).

- · Tips at restaurants: from 10% to 15% depends on the service you have received.

Electricity Service

Energy: 127 volts AC at 60 cycles (127V AC, 60 Hz). Two flat-pin plugs and some with grounding.

Transportation

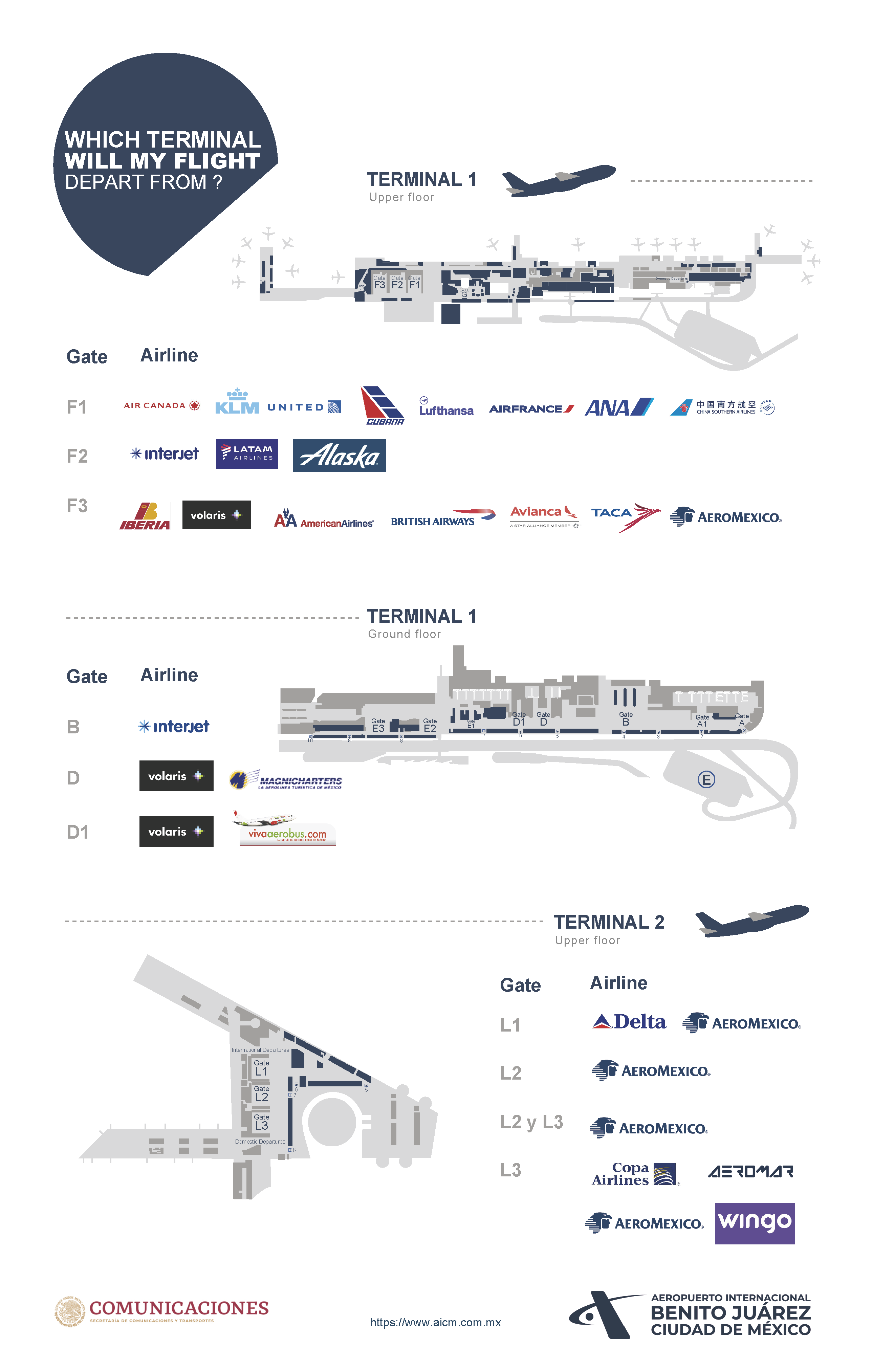

The Benito Juárez International Airport in Mexico City is located 13 kilometers from the Downtown. It has two terminals which are identified by Terminal 1 and Terminal 2 and both are connected by aerotrain and free bus transportation. For more information, you may find the airport website here.

When arriving to Mexico City, transportation from the airport to hotels can be done by transportation apps (such as Uber, Cabify, Didi and Lyft, among others), or taxi. For taxi transportation it is important to select a taxi company inside the airport (there are different options to select from once you exit customs and immigration), pay the cashier inside the airport and ask for the cab in the corresponding exit. The Mexico City International Airport (AICM) offers spaces or boarding areas for the use of authorized cabs accredited by the Ministry of Communications and Transportation (SCT) and regulated by the Airport, for more information on authorized cabs click here.

For transportation in Mexico City, we recommend participants to use transportation apps or taxi service taken from “SITIO” stands. We recommend that participants avoid taking taxis from the street. SITIO stands can be found in several locations and phone numbers to call for taxis can be obtained in the hotels.

CEMLA will not provide transportation services.

Accommodation

The following table shows CEMLA’s recommended hotels, the rates available to events participants and hotel contact information. Booking hotel is the visitors’ responsibility. Consider that hotels usually request a credit card to guarantee the reservation. For any of the booking options, remember to add 3% ISH tax and 16% VAT.

To receive the corporate rate in the recommended hotels you must specify the name of CEMLA. Any change of rates is the responsibility of each hotel. Even though some bookings can be made online we recommend contacting the hotel directly to make sure the group rate is given.

Recommended Hotels

Hotel

Rates

Reservation information

Stanza

Av. Álvaro Obregón 13, Roma Nte., Cuauhtémoc, 06700 Ciudad de México, CDMX

(3-minute car trip, 6-minute walk, 500m to CEMLA)

Ordinary rate per night:

$ 115.00 USD

CEMLA corporate rate:

$ 78.00 USD

Phone: +52 55 5080 0900

Royal Reforma

C. Amberes 78, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(12-minute car trip, 13-minute walk, 1 km to CEMLA)

Ordinary rate per night:

$ 145.00 USD

CEMLA corporate rate:

$ 71.70 USD

Includes:

breakfast buffet, wi-fi, sauna (upon request), gym, pool

Phone: +52 55 9149 3000

Four Points by Sheraton

Av. Álvaro Obregón 38, C.U. Benito Juárez, Cuauhtémoc, 06700 Ciudad de México, CDMX

(4-minute car trip, 6-minute walk, 500 m to CEMLA)

Ordinary rate per night:

$ 288.14 USD

CEMLA corporate rate:

$ 122.46 USD

Includes:

wi-fi, gym

Phone: +52 55 1085 9502

Marriot Reforma

Av. Paseo de la Reforma 276, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(15-minute car trip, 17-minute walk, 1.3 km to CEMLA)

Ordinary rate per night:

$ 419.01 USD

CEMLA corporate rate:

$ 216.11 USD

Includes:

breakfast buffet, fitness center, wi-fi in business center

Phone: +52 55 1102 7030

Sheraton Mexico City María Isabel

Av. Paseo de la Reforma 325, Cuauhtémoc, 06500 Ciudad de México, CDMX

(15-minute car trip, 21-minute walk, 1.6 km to CEMLA)

Ordinary rate per night:

Variable according to demand

CEMLA corporate rate:

15% off the public rate

Includes:

wi-fi, breakfast buffet, gym

Phone: +52 55 5242 5555

BENIDORM

C. Frontera 217, Roma Nte. Cuauhtémoc, 06700 Ciudad de México, CDMX

(8-minute car trip, 15-minute walk, 1 km to CEMLA)

Ordinary rate per night:

$ 212.50 USD

CEMLA corporate rate:

$ 74.50 USD

Includes:

wi-fi, gym

Phone: +52 55 5265 0800

Map

Visit Mexico

Mexico City is a unique visitor destination offering a wide range of attractions combining historic and modern-day life in a vibrant and friendly atmosphere. Take a day to visit the pre-Hispanic ruins of Teotihuacan, or visit the Centro Histórico and marvel at its rich architecture form the Catedral and Plaza del Zócalo to Palacio de Bellas Artes, visit world-class museums, or spend the day at some of the modern-day bustling neighborhoods and enjoy a fine dining experience at some of the world’s top-rated restaurants. For more information visit: Official Mexico City Visitors' Guide | Guía oficial para turistas de la CDMX Mexico City.

Dinning

Mexico City offers a wide variety of restaurants most of them located in the tourist areas of Polanco, Roma and Condesa near the Conference Venue.

Sightseeing/Day trips

If you are planning to stay an extra day or two in Mexico City, we recommend taking a day to visit the Centro Histórico, Coyoacán, Reforma Avenue, Colonia Roma, Xochimilco, and Chapultepec.

A day trip to Teotihuacan to see the pyramids can be arranged with the hotel concierge.

Mexico City offers some world class museums including the Anthropology Museum, the Museo Soumaya, and the Interactive Museum of Economics.